Car Allowance Rates 2025. 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Get emails about this page.

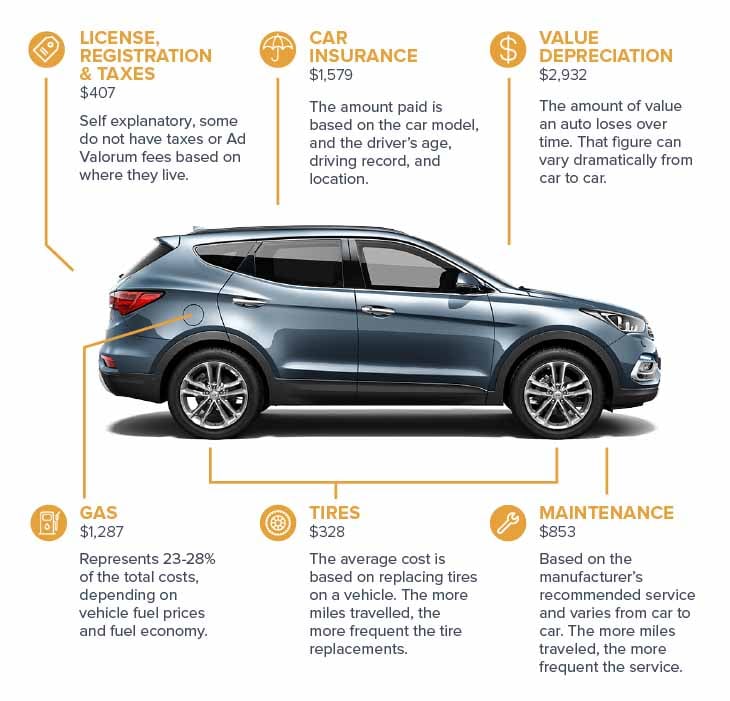

As you calculate your company car allowance or mileage rate for 2025, keep in mind the following three. Vehicle costs are facing cumulative effects of inflation in multiple areas.

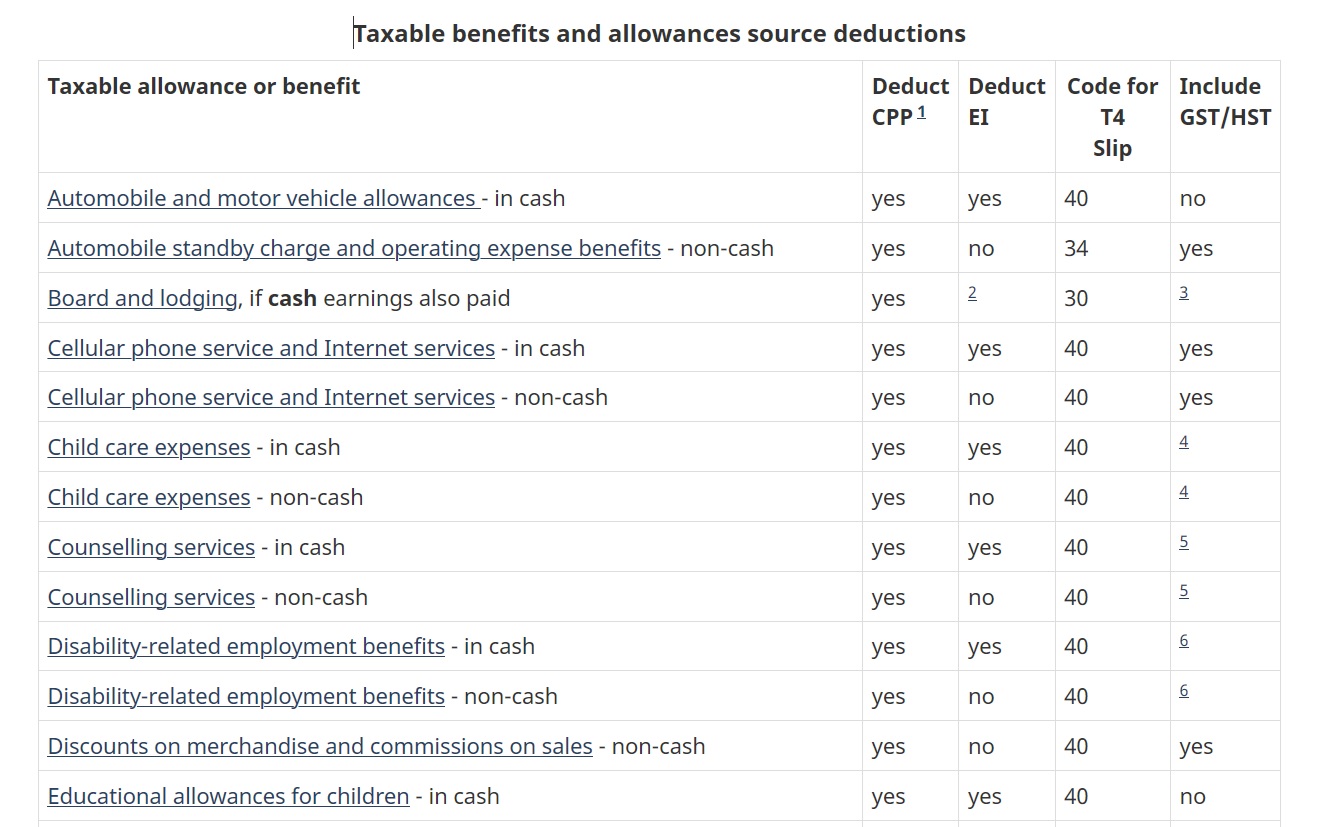

2025 Everything You Need To Know About Car Allowances, Travel — mileage and fuel rates and allowances. Yes, a car allowance is generally considered taxable income at both the state and federal levels in the united states.

Free Mileage Log Templates Smartsheet (2025), High inflation in vehicle costs. 2025 mileage rates for car allowance.

2025 Everything You Need To Know About Car Allowances, Get emails about this page. 64¢ per kilometre driven after that.

Timeero Car Allowance An Employer’s Guide for 2025 Timeero, 70¢ per kilometre for the first 5,000 kilometres driven. In the northwest territories, yukon, and nunavut, there is an additional 4¢ per kilometre allowed for travel.

Car Allowance Tax Calculator CassiekruwFinley, Car expenses and use of the standard mileage rate are. No changes have been announced by the finance minister nirmala sitharaman in the income tax slab rates in interim budget 2025.

Fair Car Allowance Calculator Calculator Academy, What are the other options when it comes to employee mileage reimbursement? 64¢ per kilometre driven after that.

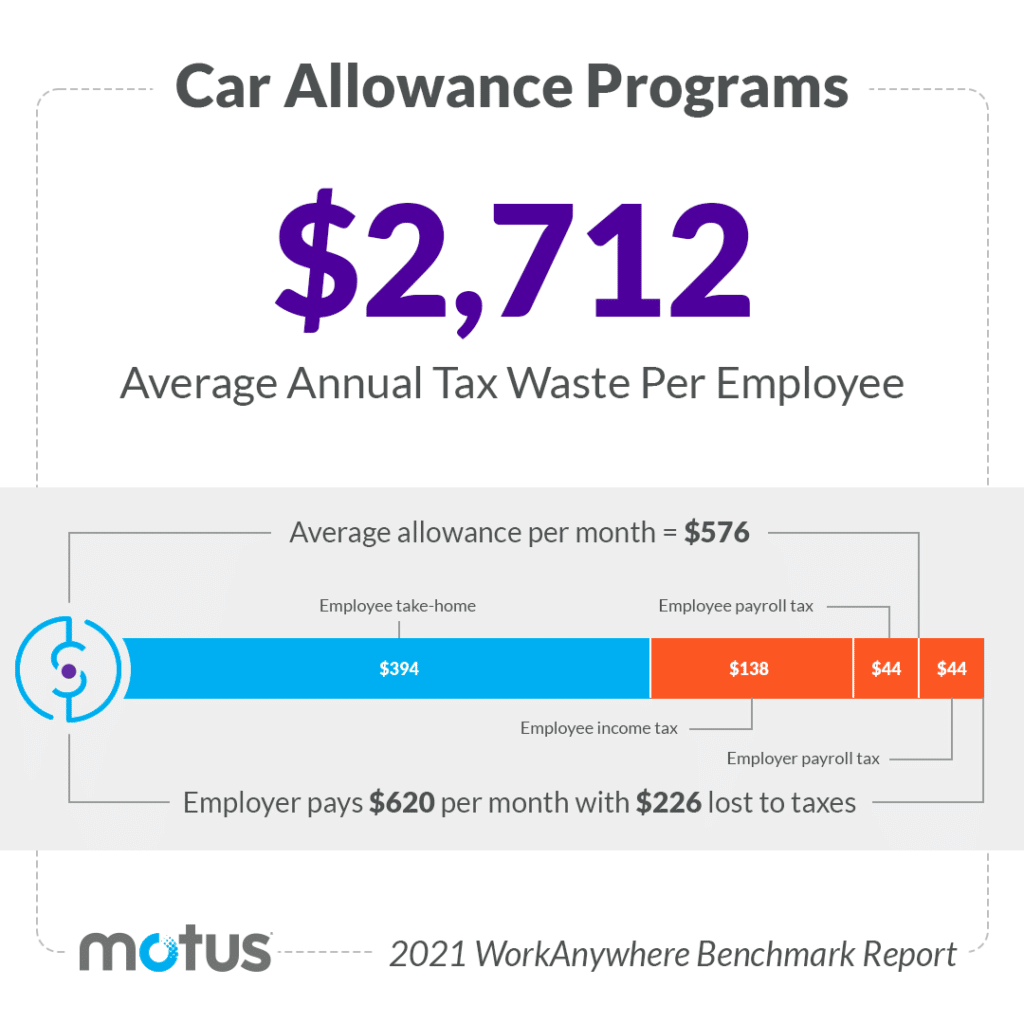

Vehicle Programs The Average Car Allowance in 2025, If you are an employer, go to automobile and motor vehicle allowances. 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Tax rates for the 2025 year of assessment Just One Lap, In the northwest territories, yukon, and nunavut, there is an additional 4¢ per kilometre allowed for travel. 5 reasons to update your car allowance for 2025:

The Prescribed Travel Rate per KM increases and the Determined Travel, What is a car allowance? What does car allowance mean?

Car Allowance Tax in Australia for 2025 A Complete Guide, Yes, a car allowance is generally considered taxable income at both the state and federal levels in the united states. Hmrc fuel rates for private cars 2025 are advised through their mileage allowance scheme, which takes into account a wider variety of costs.

1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: